What is Zcash and how does it work?

Zcash was not always in the spotlight. I remember when it quietly launched years ago. Now, understanding what Zcash is and how it works helps explain why its mining has gained attention again.

Zcash (ZEC) is a privacy-focused cryptocurrency launched in 2016. It works like Bitcoin (21 million coin cap, proof-of-work mining) but adds the ability to make transactions fully private using advanced encryption (zk-SNARKs).

Zcash was created as a fork of Bitcoin’s codebase, meaning it started with Bitcoin’s DNA but introduced a crucial twist – privacy. Just like Bitcoin, Zcash has a fixed supply of 21 million coins and follows a regular halving schedule to control its supply, with no special pre-mine or instant giveaways. It’s a decentralized, permissionless network where anyone can participate. The big difference lies in how transactions are handled. With Bitcoin, every transaction detail is public. Zcash, however, gives users a choice: transparent transactions (like Bitcoin’s, visible to all) or shielded transactions that are encrypted and hidden from prying eyes.

Privacy via zk-SNARKs

Zcash’s standout feature is its use of zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge). In simple terms, this cryptography lets someone prove a transaction is valid without revealing who they are, who they’re paying, or how much they’re sending. It’s like having a notary verify a sealed envelope – the network confirms everything’s in order, but outsiders can’t see the contents. Because of this, when I send ZEC using a shielded address, only I and the recipient (or anyone we give a viewing key to) can see the details.

This optional privacy approach is important. Why? It balances compliance and confidentiality. If I need to show records (for an audit or regulators), I can use transparent addresses or share viewing keys. But if I want true financial privacy, I switch to shielded mode. This flexibility has made Zcash attractive to various users – from privacy purists to institutions that normally shy away from fully anonymous coins.

Zcash vs. Bitcoin at a Glance

To put it into perspective, here’s a quick comparison of Zcash and its parent, Bitcoin:

| Feature | Bitcoin (BTC) | Zcash (ZEC) |

|---|---|---|

| Launch Year | 2009 | 2016 |

| Max Supply | 21 million BTC | 21 million ZEC |

| Halving Schedule | ~4 years (block rewards halve) | ~4 years (block rewards halve) |

| Consensus Mechanism | Proof-of-Work (SHA-256) | Proof-of-Work (Equihash) |

| Privacy | All transactions public on-chain | Optional privacy with shielded transactions (zk-SNARKs) |

| Key Distinction | Pseudonymous but transparent ledger | Transactions can be fully encrypted for true anonymity |

As shown above, Zcash inherited Bitcoin’s economic model and security, but layered on the ability to go off-the-record when needed. This design choice is a major reason why Zcash has a passionate following – it aims to be “Bitcoin with privacy.” Over the years, technical upgrades (from Sprout to Sapling to Orchard) have improved Zcash’s privacy performance and removed early obstacles like the need for a trusted setup. With these improvements, using Zcash today is much more practical and secure than when it first launched.

Why did Zcash’s price surge from $50 to $750 so fast?

Zcash’s value spiked in just weeks, and even seasoned crypto traders were taken aback. I watched in real-time as ZEC shot up hundreds of dollars, and I was determined to figure out what drove this extraordinary climb.

Zcash’s price skyrocketed due to a perfect storm of factors: major privacy upgrades and a user-friendly wallet, a supply squeeze from halving, growing demand for financial privacy, and endorsements by big names in crypto. These combined to send ZEC soaring.

The jump from about $50 to the $700+ range didn’t happen by luck – several key developments converged:

- Technical Upgrades & Usability: Zcash’s development team (Electric Coin Company) rolled out improvements that made ZEC more usable and private than ever. One highlight was the new official wallet, Zashi, launched around this time. Its sleek design and default shielded transactions suddenly made private crypto as easy as using any mainstream wallet. When I tried it, I was impressed by how seamless it felt. Behind the scenes, the network’s Orchard upgrade and other protocol tweaks meant over 4 million ZEC were now held in shielded addresses – about 28% of the total supply. This showed that many users were embracing Zcash’s privacy features, adding confidence that the project was delivering on its promise.

- Halving and Scarcity: In late 2024, Zcash underwent its scheduled halving (just like Bitcoin’s periodic halving) which cut the mining reward and reduced new supply entering the market. Such events often create a supply squeeze and speculative buzz. By 2025, the effect of that halving was in full swing – fewer new ZEC were being minted, so any increase in demand would naturally push the price up faster. Traders knew this, and some positioned themselves ahead of time, anticipating that ZEC could follow the classic post-halving price surge pattern. Sure enough, as demand spiked, the limited supply helped drive the price rally further.

- Financial Privacy Narrative: A broader narrative took hold: privacy is back. With governments increasingly talking about Central Bank Digital Currencies and tighter crypto regulations, many investors started looking for coins that protect privacy. Zcash fit the bill as a more compliant-friendly privacy coin (compared to say Monero which is always private). Influential voices like Naval Ravikant pointed out that as Bitcoin is transparent, Zcash offers an insurance policy for privacy (more on that soon). This narrative – that owning ZEC is a bet on the importance of privacy in the future – attracted people who hadn’t paid attention to Zcash in years. It certainly struck a chord with me, as I value financial privacy.

- Market Momentum & FOMO: Once the price started climbing, fear of missing out (FOMO) kicked in. More traders piled on, and even speculators who didn’t deeply care about privacy joined because the trend was strong. Social media buzzed with ZEC chatter. At one point, Zcash’s market capitalization even surpassed that of Monero, long the king of privacy coins. That was a symbolic victory, suggesting that fresh money (possibly institutional) was flowing into Zcash. The surge was so significant that analysts observed Zcash moving opposite to Bitcoin – as Bitcoin’s price stalled, Zcash’s soared, indicating some investors rotated into ZEC looking for better gains.

✅ Key Drivers Behind the ZEC Price Surge (Simple Chart)

| Driver | Summary | Impact on Price |

|---|---|---|

| Technical Upgrades & Usability | New Zashi wallet launch, Orchard upgrade, improved privacy, 28% of supply held in shielded addresses | Builds confidence, attracts long-term holders |

| Halving & Scarcity | Late-2024 halving reduced block rewards and new supply | Creates supply pressure and amplifies upward moves |

| Financial Privacy Narrative | Rising global regulation, talk of CBDCs, renewed demand for privacy coins | Attracts institutions and privacy-focused investors |

| Market Momentum & FOMO | Price rally triggered more traders → more momentum → more hype | Accelerates the surge to the $700+ range |

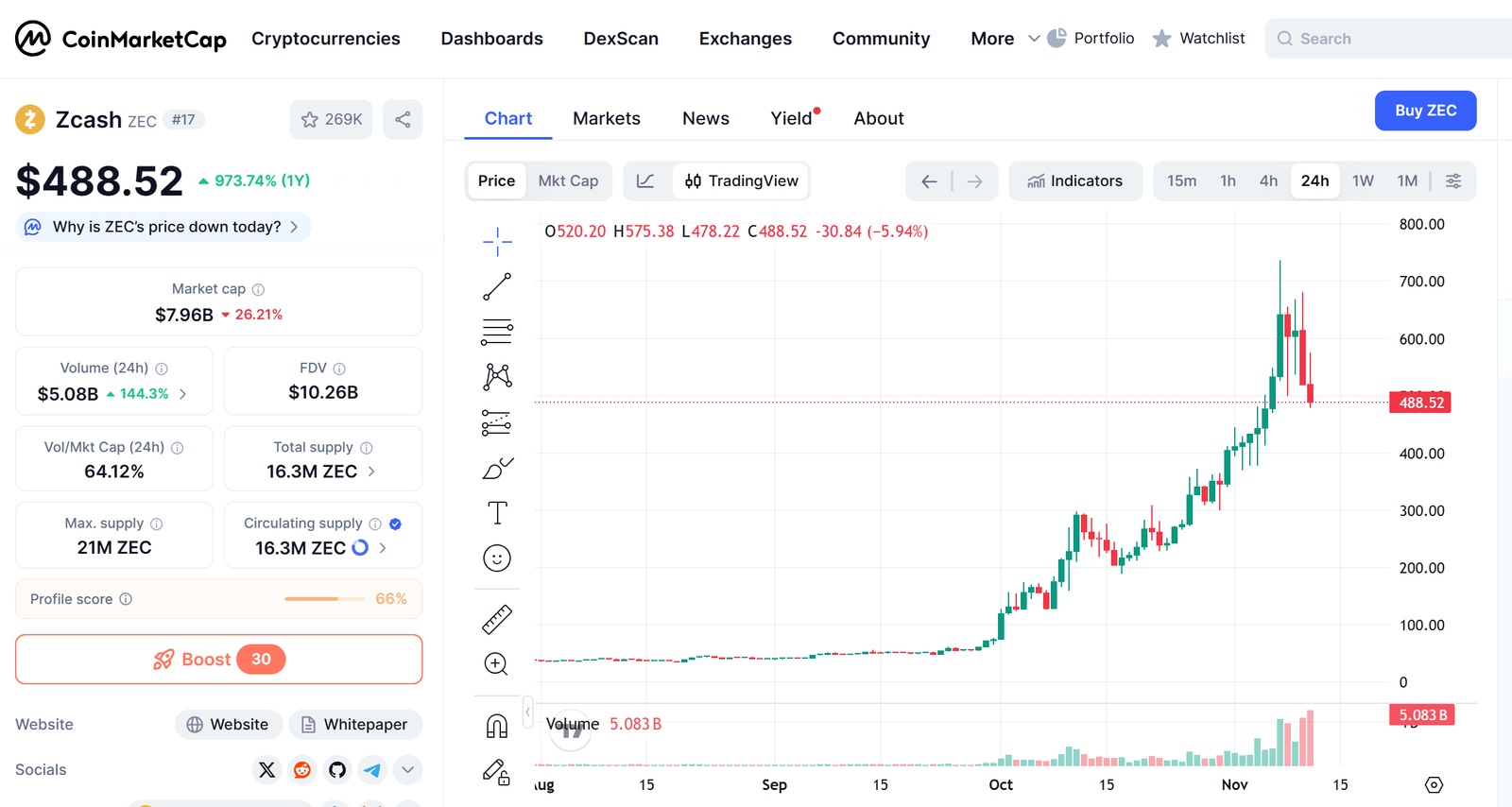

Figure: ZEC price surge (Sep to Nov 2025) – starting under $50 and peaking around $750. A series of rallies (and a brief dip) highlight the rapid rise in interest.

Looking at the figure above, you can see how dramatic the ascent was. By early November 2025, ZEC hit roughly $730 on major exchanges (some reported spikes up to ~$750). It’s the highest price Zcash had seen since early 2018, wiping out years of decline in a short span. As someone who has mined various coins through bullish and bearish cycles, I found this resurgence both exhilarating and a little alarming – exhilarating because of the renewed profitability for miners, and alarming because such rapid rises can invite volatility and risk.

Crucially, the reasons behind the surge suggest it wasn’t pure hype. There were real improvements and real-world narratives driving it. That makes me more confident that this interest in ZEC might have some staying power, compared to a random meme coin pump. Of course, nothing is guaranteed in crypto, but understanding these drivers helps me and other miners gauge how sustainable the trend might be.

Which major players are bullish on Zcash (ZEC)?

Seeing high-profile figures bet on Zcash gave me an extra boost of confidence. Typically, big institutions and seasoned investors avoid privacy coins due to regulation, so it was surprising to see some openly support ZEC.

Notable investors and crypto figures have turned bullish on Zcash. For example, Arthur Hayes (co-founder of BitMEX) revealed that his family office’s second-largest crypto holding is now ZEC. Such endorsements from industry leaders have further fueled optimism around Zcash’s future.

One of the most talked-about endorsements came from Arthur Hayes, a well-known figure in the crypto world. In late 2025, as Zcash’s price was climbing, Hayes announced that ZEC had become the second-largest liquid holding in his fund (only Bitcoin was bigger). For context, Hayes co-founded the BitMEX exchange and is followed closely by traders. His vote of confidence was a big deal – it signaled that even a veteran who made his name in Bitcoin trading saw unique value in Zcash. He attributed this move to ZEC’s rapid price appreciation and its long-term potential, calling the privacy coin one of his top bets. When I read his statement, I felt validated in my own interest; it’s not every day that a top trader aligns with what us miners are excited about.

Hayes isn’t alone. Naval Ravikant (a famous tech investor) also publicly praised Zcash (more on his reasoning in the next section). Additionally, some crypto investment funds and venture firms have been highlighting Zcash’s technology in their analysis. For instance, IOSG Ventures put out a detailed report explaining Zcash’s tech upgrades and why the coin was gaining traction. Their analysis noted how Zcash’s hybrid approach to privacy (allowing both private and transparent transactions) could make it appealing to more mainstream users and institutions who need to comply with laws.

Even the market data hinted at institutional interest: the fact that Zcash’s market cap overtook Monero’s and pushed above $8 billion suggested that new capital was coming in. Monero has long been popular with individuals for privacy, but institutions mostly stayed away from it due to its always-private nature. Zcash, with its opt-in privacy, might be seen as a more institution-friendly privacy coin. It can offer financial privacy without completely alienating regulators – a balance that is drawing in a broader range of investors.

Of course, this doesn’t mean every institution is piling into ZEC. Many large traditional investors still avoid coins that could raise regulatory eyebrows. However, the landscape seems to be shifting. I’ve observed that even mining inquiries we get are not just from small hobbyists; some are from larger entities who operate mining farms and are considering diversifying into Zcash mining. They cite the same reasons – growing privacy narrative, strong backing by known figures, and improved tech.

In summary, when influential people publicly back a cryptocurrency, it tends to create a positive feedback loop. The endorsements by folks like Hayes (and others hinting at their support) brought more eyeballs to Zcash. It made ZEC feel “legitimized” in a sense, which is somewhat ironic for a coin centered on privacy. Personally, it reminded me that in crypto, narratives can flip quickly – a coin once considered niche can become the next big thing if the right people get behind it and the fundamentals improve.

| Category | Who | Why They’re Bullish / Key Points |

|---|---|---|

| High-profile Individuals | Arthur Hayes | ZEC is his fund’s 2nd-largest holding; believes in long-term potential; strong endorsement boosted confidence |

| Naval Ravikant | Publicly praised Zcash; sees ZEC as a needed privacy layer for the future | |

| Crypto Funds & Analysts | IOSG Ventures | Published detailed analysis on ZEC upgrades and the strength of its hybrid privacy model |

| Market Signals | Institutional capital (implied) | ZEC market cap surpassing Monero signals fresh, larger capital inflow |

| Mining Sector Shifts | Large mining farms | Increasing number of inquiries from bigger operators looking to diversify into ZEC mining |

Why does Naval say Zcash is “insurance for Bitcoin”?

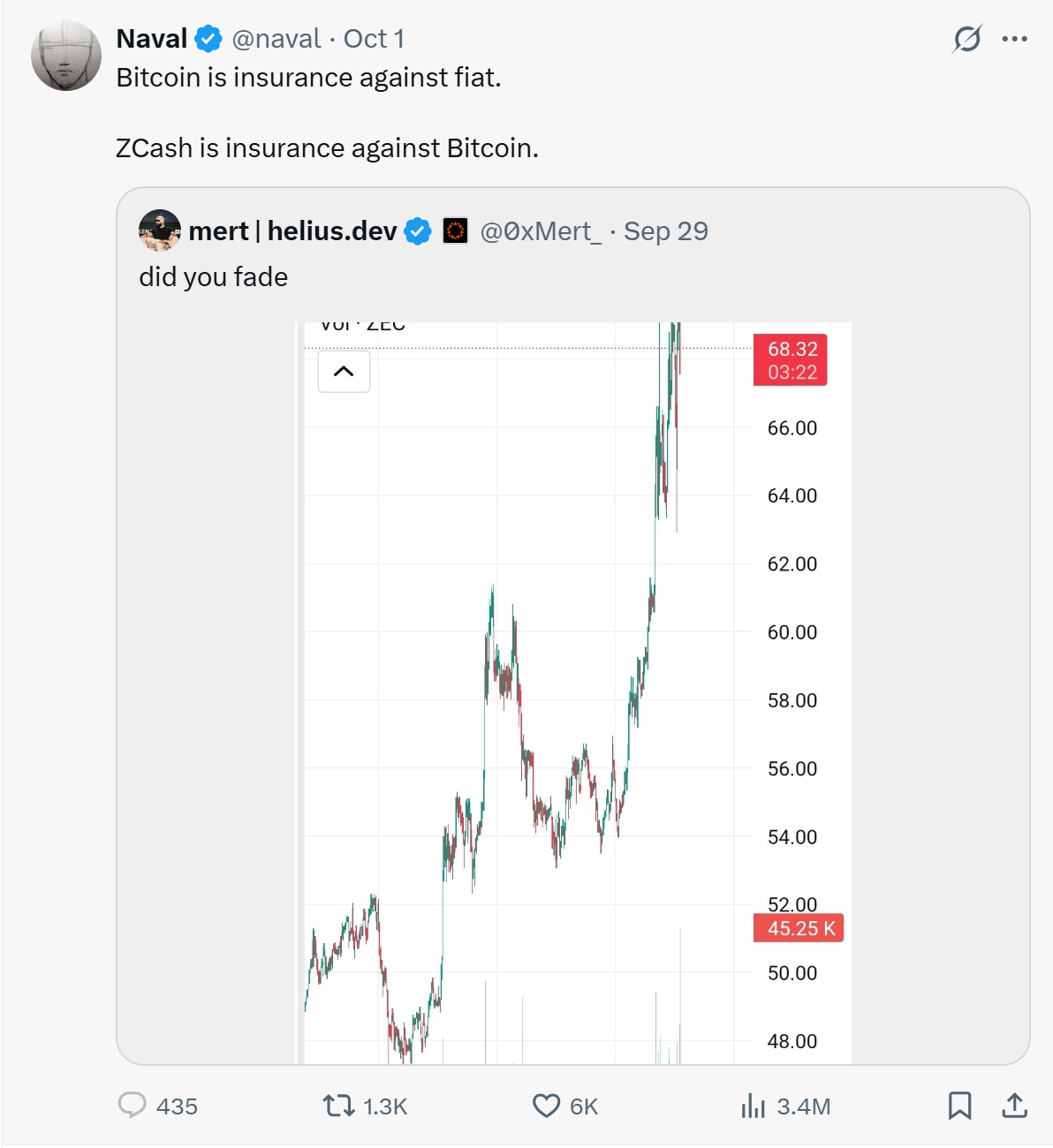

When I saw Naval Ravikant’s comment that “ZCash is insurance against Bitcoin,” it stopped me in my tracks. Naval isn’t someone who hypes things lightly, so I was intrigued to unpack what he meant by calling Zcash an insurance policy for Bitcoin.

Naval Ravikant believes Zcash offers protection where Bitcoin cannot – personal privacy. He famously stated, “Bitcoin is insurance against fiat; Zcash is insurance against Bitcoin,” meaning if Bitcoin’s open ledger becomes a liability under surveillance, Zcash’s privacy features are a safeguard.

To understand Naval’s point, consider what Bitcoin represents and what it lacks. Naval’s saying “Bitcoin is insurance against fiat” refers to Bitcoin being a hedge against traditional money and central bank policies – if governments devalue currency or if the banking system falters, Bitcoin is like an insurance policy for your wealth. However, Bitcoin’s blockchain is completely transparent. Every transaction is public forever, which means it doesn’t protect privacy. This is where Naval brings in Zcash: “Zcash is insurance against Bitcoin.” He’s highlighting that Zcash can insure against Bitcoin’s own risk – the risk of lack of privacy.

In a world of increasing surveillance and the rise of central bank digital currencies (which could track every transaction), Bitcoin’s transparency might become a downside. Naval pointed out that even Bitcoin’s creator would struggle to use Bitcoin anonymously today because powerful analytics can trace addresses. Zcash, by contrast, was built to solve this exact problem by encrypting transaction details. So if one believes in the vision of cryptocurrency as financial freedom, Zcash acts as a policy protecting that freedom when Bitcoin alone might not suffice.

When Naval made that statement (on social media around October 2025), it wasn’t just a philosophical musing – it coincided with a significant market reaction. His endorsement of ZEC as a privacy safeguard helped spark a rally in Zcash’s price. Suddenly, a lot of people (myself included) started paying more attention to Zcash. It’s not often that Bitcoin advocates endorse an altcoin so strongly. Naval is respected in both tech and crypto circles, so his words carried weight. They validated the idea that privacy coins have a crucial role, even in a Bitcoin-dominated environment.

A Closer Look at the “Insurance” Analogy

To break down the analogy:

- Bitcoin vs. Fiat: Bitcoin provides a decentralized, inflation-resistant store of value, which is why it’s considered an insurance against the problems of fiat money (like inflation or censorship by banks).

- Zcash vs. Bitcoin: Zcash provides an option for privacy. If using Bitcoin becomes akin to broadcasting your financial history to the world (or to governments), Zcash offers a way to opt out of that visibility. It’s like having an insurance policy that kicks in specifically if transacting in Bitcoin exposes you to surveillance or loss of fungibility.

Naval’s comment also sparked discussions about other privacy solutions, from Monero to upcoming Bitcoin privacy tech. Some critics noted that Zcash’s privacy is optional, so if few people use it, it could be less effective (a smaller anonymity set). Others pointed out that Naval has been involved with Zcash’s community or investors, implying he has a bias. I think healthy skepticism is fine – after all, in crypto, everyone has a thesis or interest. But the core of his argument is technically sound: Bitcoin and Zcash solve different problems, and they complement each other.

As a miner, I find this perspective useful. It reminds me that Bitcoin isn’t the end-all for every use case. Zcash’s surge in mining popularity can be seen as the market recognizing that the privacy use case is important. Naval’s catchy “insurance” phrase just captured that idea in a memorable way. It certainly got me thinking more long-term: if I believe Bitcoin will succeed as a new form of money, I also have to consider what complementary tools (like Zcash) might rise alongside it to address Bitcoin’s gaps.

How can you obtain ZEC tokens?

With all the excitement around Zcash, the next practical question is how to get your hands on some ZEC. I faced the same question and realized there are two main routes to obtaining ZEC, each with its own considerations.

You can obtain ZEC either by buying it on a cryptocurrency exchange or by mining it yourself. Buying Zcash from an exchange is quick and straightforward (you pay the market price per coin), whereas mining Zcash requires investing in hardware and electricity to earn new coins at a potentially lower effective cost.

If you’re looking to accumulate Zcash now, here’s a closer look at your options:

- Purchasing ZEC on Exchanges: The fastest way is to buy ZEC on a crypto exchange. Major exchanges like Coinbase, Binance, and others list Zcash, given its established presence in the market. Buying is as simple as placing an order with your local currency or Bitcoin. The upside is instant gratification – you get the ZEC immediately (or within minutes) into your wallet. However, the downside is cost. During the recent surge, ZEC’s price was in the hundreds of dollars. If you believe in Zcash’s future, buying at $700 each means a significant upfront expense. Also, exchanges charge fees, and large purchases can even move the market price. For a small investor, buying a bit of ZEC for exposure is convenient. I’ve bought some coins this way when I wanted to top up quickly. Just remember to withdraw your ZEC to a secure wallet (like ZecWallet or Zashi) if you want to take advantage of privacy features – keeping coins on an exchange won’t give you any privacy benefits.

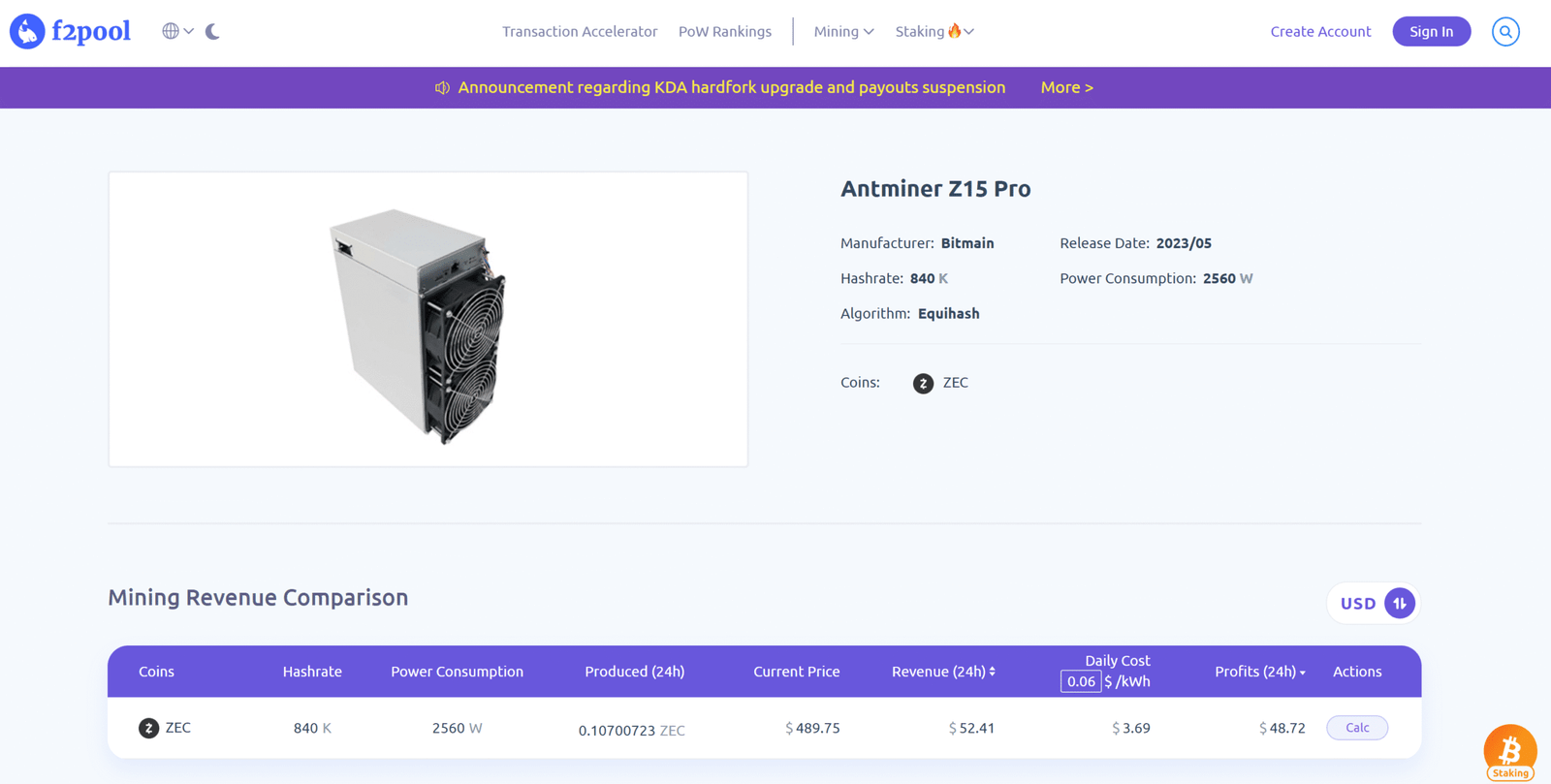

- Mining ZEC: The alternative is to mine Zcash, which is the route I’m more deeply involved in. Mining ZEC means using specialized hardware to solve cryptographic puzzles, thereby securing the network and earning Zcash as a reward. Zcash uses an algorithm called Equihash for mining. In the early days, people could mine ZEC with GPUs (graphics cards). But now, like Bitcoin, there are ASIC miners built for Equihash that vastly outperform GPUs. Examples include Antminer Z15pro (from Bitmain) that are designed for Zcash, among other manufacturers. Mining has a higher barrier to entry than buying – you need to purchase the mining rigs, set them up (which involves some technical know-how), and pay for electricity and possibly cooling. The initial investment can be substantial, but the benefit is you are acquiring ZEC at the cost of mining (hardware + power) rather than the full market price. Essentially, if your mining operation is efficient, you might get coins at a discount versus buying outright, especially over a long period. Mining also continuously releases new ZEC to you, which can build up your position over time.

Buying vs. Mining: Pros and Cons

To help decide which path might suit you, consider the following comparison:

| Method | Pros 🟢 | Cons 🔴 |

|---|---|---|

| Buy on Exchange | – Instant access to ZEC once purchased.- Simple process via trading apps/websites.- No need to manage hardware or worry about maintenance. | – Pay full market price per coin (can be high).- Exchange fees and possible slippage for large buys.- No privacy benefit if coins stay on exchange. |

| Mine ZEC | – Potentially acquire ZEC at lower cost over time.- Continuous accumulation of coins (daily mining rewards).- Contribute to network security as a miner. | – Requires upfront investment in mining rigs (ASICs).- Ongoing costs for electricity and maintenance.- Need technical setup and space (heat/noise considerations). |

As someone who runs a mining operation, I might be biased towards mining – I enjoy the process and the idea of earning coins. In fact, I turned my passion into a business: I operate Miner Source, a mining hardware supplier based in China, helping clients worldwide get started with crypto mining. We have warehouses in Hong Kong and Shenzhen and ship equipment like Antminer and Whatsminer rigs to North America, Europe, the Middle East (Dubai, UAE), and elsewhere. The reason I mention this is because lately we’ve seen a spike in inquiries for Zcash-capable miners. Businesses and crypto enthusiasts (like large-scale mining farm operators and even some blockchain hobbyists) are reaching out for hardware, influenced by ZEC’s price boom. We pride ourselves on reliable and fast service – when someone orders a miner from us, we understand they want to capitalize on trends quickly, so having stock in strategic locations helps cut down delivery time significantly.

Whether you choose to buy or mine, the key is doing your homework. If buying, decide on a good entry point and use a reputable exchange. If mining, calculate your potential return on investment: factor in miner cost, your electricity rate, and the current network difficulty. I often help clients run these numbers. For example, if a mining rig costs X dollars and produces Y ZEC per month, how many months until it “pays for itself” at current prices? These considerations ensure you approach ZEC accumulation wisely.

In summary, buying Zcash is like paying a lump sum to jump on the train, whereas mining is like building the train’s engine and getting paid in tickets (coins) as it runs. Both paths can lead you to hold ZEC – it just depends on whether you want to invest more money or more time and effort.

Conclusion

Zcash’s mining renaissance isn’t a random fluke – it’s the result of price momentum, technical innovation, and influential endorsements aligning. In my journey through this resurgence, I’ve learned how quickly the crypto landscape can change, and it’s reinforced my belief that staying informed and adaptable is key in this ever-evolving industry. Contact Miner Source Purhase Z15pro to Mining ZEC Now!